By Rami Ibrahim

February, 08, 2020

Introduction

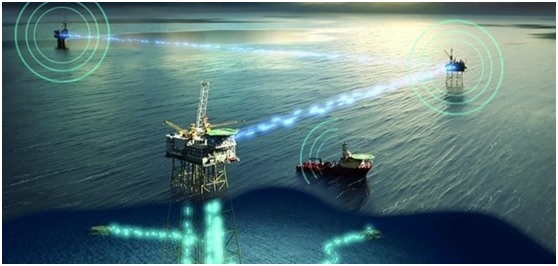

The energy market continues to expand with oil and gas remaining in the spotlight of the commercial fossil fuel vertical. Meanwhile, as the fossil fuel demand is skyrocketing, the exploration and production plans are increasing the capacity to deliver oil and gas products to their final markets. The communications system for onshore/offshore rigs, fixed platforms, and supervisory control and data acquisition (SCADA) are becoming the crucial part of the energy SatCom market. Simultaneously, the exchangeable data that is being consistently uploaded from the rigs during the drilling operation is essential for geophysical exploration studies. Therefore, the end-user’s dependency on reliable and stable communication to upstream and downstream real-time data from the remote sites is increasing with time. The communications system’s demand is increasing in the oil and gas sector, and the satellite industry with its advanced emerging technologies will be playing a key role in improving the operations of the oil and gas sector.

Space and Terrestrial Challenges

Satellite communication is a strong pillar of data transmission for drilling rigs because of the mobility. And due to the flexible coverage capabilities of the satellite, as a ground segment, there is a less effort in building infrastructures, as required to install onboard very small aperture terminal (VSAT) technology for data, voice, and video connectivity, in addition to the mobile satellite services (MSS) for emergencies and connectivity on the move such as voice and data. But the Fiber optics is also important for a fixed platform. The fixed and non-mobile platforms that belong to oil and gas are usually connected by fiber optics. Because fiber means greater redundancy and stability, more competition for low latency connectivity, and more bandwidth. On the other hand, using the satellite VSAT in fixed platforms become as a backup in case of fiber failure. Both technologies are important and complement each other. End users are expecting more capacity in the future, but also the demands of changing the technology from customer to others are different. Some customers view satellite technology as a reliable choice while fiber optics sensing rises. But there are limitations and constraints that which solution or technology is to be implemented in the right place. Currently, the best choice for the drilling rigs is the satellite because of the mobility, as the deployment of fiber optics in remote areas requires a heavy investment for developing a suitable infrastructure.

Current Challenges and Future Demands of Satellite Capacity

Since past few years, the demand for the satellite bandwidth is increasing year by year, to run more satellite applications on both offshore and onshore rigs. And also, SCADA addresses oil and gas field challenges, and these demands are coming on the basis of real-time applications, as new drilling rigs keep entering the market because of the persistence of new sites by exploration companies. End-user and customers have started looking for robust but lower-cost alternatives because leasing the traditional satellite transponder is expensive; also facing the high latency issues via satellite. From the past decade, many satellite operators have announced and launched the High Throughput Satellite (HTS) networks. The HTS is defined as an emerging technology that is designed to meet the end-user demands for the low cost by frequency reuse and directed multiple spot beams to increase throughput and reduce the cost per bit delivered. There are numerous satellite operators that provide HTS services such as Eutelsat, Inmarsat, Intelsat. Most of the indications and forecasts have conducted by market research shows the increase of the HTS as In-service units. But it will take time for the newer HTS systems to be implemented faster within the oil and gas community. The research shows that the oil and gas industry’s demand will increase to approximately 17 Gbps on HTS technology by 2022, with growth starting to take off after 2017. On the other hand, the New Space of low-earth orbit (LEO) constellations, operators such as Telesat, OneWeb, SpaceX will offer a huge capacity that will reach up to tens of Tbps with maximum data-rate per satellite reach to tens of Gbps as per researcher’s estimation, and decreasing in capacity price as promised.

Ground Manufactures, Emerging Technology and Application

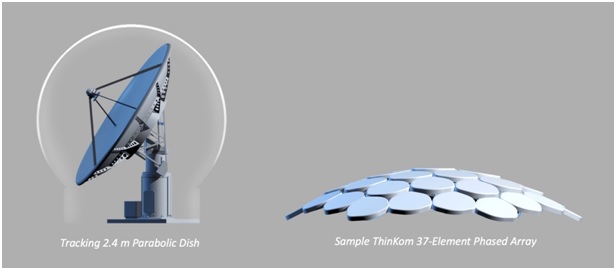

The satellite ground segment domain is also adapting to the demands of the new communication markets. Companies like ST Engineering iDirect, Phasor Solutions, and ThinKom are developing and testing new technologies related to modem platforms and antennas to meet the rapidly evolving market demands of LEO, MEO, and GEO business verticals. As the market is now inclining towards the phased array/flat-panel antennas, it is time for the industry to also rethink with new Gateway arrays not only the traditional parabolic dish antennas, as it is also capable of offering multi-beam.

On the other hand, a start-up Isotropic Systems is implementing, and testing the next generation of the ground terminals and will offer a Ku and Ka-bands. Using the optical beam-forming modules will reduce the required circuitry and power consumption which leads to reduce terminal cost. It will be a fully integrated terminal accepting two different modem cards, and the antenna will be supported to operate two independent links for handover, diversity, and link aggregation.

An emerging application of the Internet-of-Things (IoT); satellite IoT communications is taking a big place in the oil and gas field. There are many start-ups are working to build their satellites constellation for IoT applications such as Astrocast, KINEIS, and OQ Technology. Currently, Iridium with its new next generation of 66 satellite constellations, Iridium CloudConnect offers global coverage for IoT applications through Amazon Web Services (AWS) to connect customer devices.

Conclusions:

The satellite communication systems are the backbone of the oil and gas fields. With new satellite technologies making their way to various energy market verticals, oil and gas remain one the most lucrative market segment for the satellite industry. The traditional fixed satellite services (FSS) of Ku-band will keep expanding but, the geostationary-earth orbit GEO-HTS and medium-earth orbit MEO-HTS of Ka-band are gradually taking a place for onshore and offshore rigs such as SES O3b Networks. Also, many satellite operators are in-process of developing and deploying Very-HTS networks in GEO and LEO. Similarly, the ground terminals will enhance the operation on-board and reduce the complexity of RF infrastructure, maintenance, and cost. The satellite-based IoT will help many devices, such as SCADA, to improve the efficiency and productivity of the offshore and onshore sites. In general, the process of satellite-based IoT operation will be small products with low power, installed in the remote sites. Therefore, the data will be sent to the satellites and then the signal sends back to the ground station and these data will be uploaded on the cloud. Moreover, customers will be able to access it and monitor their machines and devices remotely.