By Omkar Nikam

April 22, 2020

Introduction

The technological breakthroughs have consistently changed the transportation systems around the world. While satellite communication (satcom) and navigation remain the important parts of integration for the transportation systems, the satellite industry is all set to amplify the innovation pace of the global transportation systems. Satcom industry has been leading various mobility sectors, such as aviation for the past few decades. And now, with the rising demand for autonomous as well as urban air mobility (UAM) vehicles, satcom companies have a chance to lay down an innovative path for enhancing the communication capabilities of the future transportation systems.

Considering the increasing demand for autonomous vehicles, the UAM market is yet to see the dawn of market entry. And, with the possible fusion of both private and public organisations, UAM will also unlock several civil and commercial applications in emergency management. This will, in turn, increase the demand for precise satcom as well as navigation. Though the world is currently observing the rise of autonomous vehicles, the UAM sector is still in the process of deploying and revolutionising the short-route travel systems. As satcom will be playing a pivotal role in both the emerging transportation systems, following are some of the points that both investors and entrepreneurs should consider before expanding their businesses.

The Legal Barriers

Regulators and policymakers will be taking the hot seat behind the revolutionary market entry of UAM vehicles. On the other hand, autonomous cars have passed this hurdle in a few countries, but with only partial automation approval. Countries like the USA are yet to approve the full automation, and currently, the country has only allowed partial automation in less than 40 states. Therefore, both UAM and autonomous vehicles must pass through a certain number of regulatory barriers to flourish the land and air transportation market. Until the regulatory policies for both the UAM and autonomous vehicles are fully resolved and brought into action, the satcom companies have valuable time for iteration of the technology. With the upcoming wave of 5G and Hybrid Networks, the satcom industry has an opportunity to take centre stage at the technology level integration for precise automation. Therefore, both New Space and traditional Space companies, operating in the satcom domain, should also give some more critical thoughts to their existing technologies. And this can be a starting point of innovative commercial wave in the satcom applications for UAM and autonomous vehicles. Though the future of regulatory aspects depends on the advancement of Artificial Intelligence (AI) and Machine-to-Machine (M2M) technology, the satcom industry has the time to rethink and create a more valuable supply chain for future demands aligning with the regulatory policies.

Hidden Market Opportunities

The commercial opportunities for short-route travel in both UAM and autonomous verticals are visible as well-known companies like Airbus, Lilium, and Uber have laid down a healthy market plan for their respective businesses. But, maritime, disaster management, and agriculture are also some of the key verticals where satcom integration will bring value to the end consumer. For example, smart farming is the vertical that is currently utilizing Global Navigation Satellite System (GNSS) and satellite imagery for most of its field operations. While the integration and use of satcom systems based on 5G or Hybrid Networks in the daily farming operations will provide a more productive yield to the farmers. As well as it will also help the farmers cut down their operation costs by turn at least a few of the utilities towards automation.

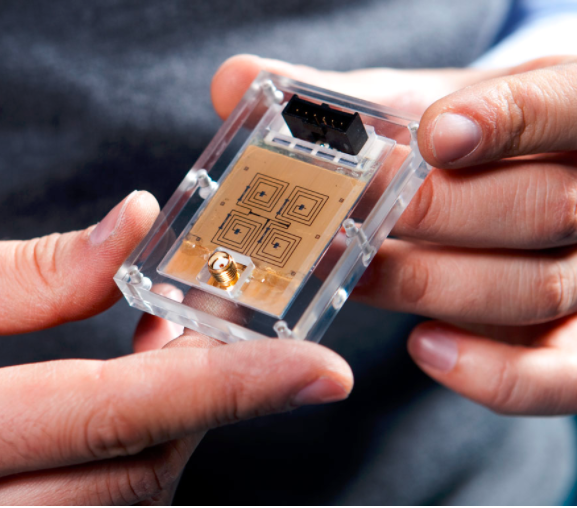

On the other hand, the hardware segment is evolving as per the demand of the market. And phased array antennas or so-called flat panel antenna (FPA) are uplifting the demand curve for integrating satcom in UAM and autonomous vehicles. The FPAs are currently one of the most flexible and reliable satcom hardware that can be installed on the vehicles. Kymeta, Phasor, and ThinKom are some of the key players in the FPA. On the other hand, Alcan Systems, a Germany based FPA manufacturing company, is developing a new class of innovative smart antennas—ultra thin liquid crystal flat panel technology, very low power usage, and able to adjust its beam electronically without any moving parts. With this being said, satcom will also be joining hands with GNSS, as the precise location is of utmost importance for both UAM and autonomous vehicles. Though satellite-based IoT too will be playing a vital role in autonomous vehicles, it is by far safe to say that the satcom industry will hit the gold mine if carefully analyzed the market supply and demand of UAM and autonomous vehicles.

Impact of COVID-19 and Future Outlook

In the wake of COVID-19, many industries like aviation are now flattening their curve. And it can be said that the global transportation systems might remain flat for a few weeks or months, depending on the government decisions. But this doesn’t stop the entrepreneurs and tech innovators from navigating for new opportunities based on the current global health emergency. In the present scenario, we can observe how UAM would have helped reduce the transport difficulties in the most crowded cities like Tokyo, Mumbai, Beijing, New York, etc. with satcom playing a pivotal role in the crisis communication management.

The COVID-19 will leave a trail of economic crisis and present the world with new challenges. But, we as the space industry experts have the opportunity to revive and help as many as businesses roll out back to normal by presenting them with our existing satellite technologies that might help them reduce their operational costs. The future remains uncertain, but it is worth noting that the upcoming wave of satellite broadband, with SpaceX’s Starlink and Amazon’s Kuiper playing a key role in the global market, will amplify the opportunities in various transport management systems.

Conclusion

The global outlook of UAM and the autonomous vehicle is yet to see the rising curve, as these transportation verticals are easily accessible and available in only the developed nations. On the other hand, as the satcom industry gears for a post-COVID-19 era with the amplification opportunities in the broadband sector, the autonomous vehicle market vertical looks more promising, as UAM still has to pass several regulatory hurdles. Considering the role of UAM in courier delivery, Amazon is currently in the process of developing a product delivery via drones. This provides a broader perspective that the future of satcom in UAM looks promising but the market entry time remains uncertain. Overall, we can say that the integration of satcom systems will be essential for both UAM and autonomous vehicles.