Image Credits: Wood Mackenize

By Omkar Nikam

February 19, 2020

Introduction

The video broadcasting industry’s rapid adaptation to new technologies has created a new arena of opportunities for broadcasting companies. Satellite broadcasting is one of those industries which is reshuffling its technology to meet the demands of video customers. While past decade gave a vibe that satellite technology needs to upgrade its downstream utilities, satellite TV remains a popular video consumption mode for some of the biggest broadcasting markets such as Asia, the Middle East, Africa and Europe. Though other regions of the world experienced a slight fluctuation in the overall business, the satellite industry’s action plan to integrate both terrestrial and satellite solutions will amplify the opportunities in the Over-the-top (OTT) and Internet Protocol Television (IPTV) verticals. Simultaneously, as the upstream satellite market is investing in some of the key satellite technologies such as small satellites, Very-high Throughput Satellite (VHTS) and low earth orbit (LEO) business models, both satellite broadcasting and broadband will see the rise of hybrid era in this new decade. Therefore, as the satellite industry is progressing to unlock its full potential in the broadcasting segments, we are briefly presenting some of the important points that will boost the presence of satellite technology in 2020 and beyond.

Hybrid Solutions are the KEY

The year 2019 presented some of the key areas of business for the satellite broadcasting industry in different segments such as OTT via Satellite, Digital video distribution via satellite cloud technology, etc. This scenario suggests that the demand for hybrid video technology will be rising in the coming decade. In countries like India and Brazil, which are the well-known direct-to-home DTH market hotspot, the digital terrestrial television (DTT) services are on the rise due to the improvisation in the broadcasting infrastructure. Therefore, the integration of both terrestrial and satellite solutions is the best way to grab hold of such a huge video market. Eutelsat, Intelsat and SES are some of the well-known players in the hybrid satellite services domain. Moreover, Eutelsat deployed its OTT via satellite services in early 2018 and have already bagged few customers from the North American region.

The backend technology necessary to accelerate the OTT via satellite market has also started taking off from the past two years. Broadpeak, Quadrille, ST Engineering iDirect and Anevia are some of the companies spearheading the backend technology market for distributing OTT content via satellite. This gives us a clear picture of how satellite technology will be able to grab hold of the evolving video market. Therefore, the hybrid broadcasting technology age will make the satellite industry as one of the strong pillars of this market to accelerate the video content distribution on a larger scale.

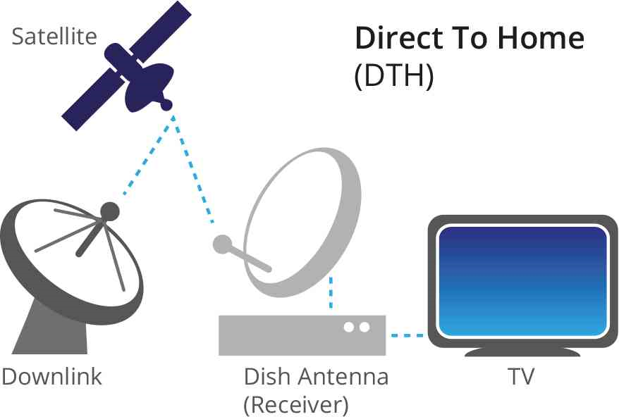

DTH is Still the Driving Force of the Commercial Satellite Market

A lot has been said about the declining revenues of the satellite TV companies, but DTH still wins the race some of the most populates regions like Asia. Companies like Dish Network, which experienced a loss of thousands of subscribers in the first and second quarter of 2019, recorded overall growth in the subscribers in the fourth quarter of 2019. Similarly, Sky UK also registered a growth of more than 70,000 subscribers through its parent company, Comcast. Due to the cord-cutting phase, both cable and DTH operators are losing subscribers. But this also presents an opportunity for the companies to navigate through emerging technologies and revamp the satellite TV market. For example, the entry of cloud platforms like Amazon Web Service (AWS) and Microsoft Azure in the broadcasting segment will help the satellite operators to keep a hold on to both DTH and DTT markets.

In countries like Russia, the DTH market is experiencing healthy growth as per the 2019 data. According to various sources, Russia’s leading DTH and pay-TV operator, Tricolor and NTV plus, are planning to merge with a deal close to USD 1 billion. The merger will possibly help both the companies to grab more than 10 million subscribers from the Russian region. While Europe, Middle East, Africa and Asia, remain the core markets for the industry, with companies like Canal+ creating a new foundation for DTH businesses. Canal+ partnered with Netflix for broadcasting one of the mini-TV series, THE SPY, in September 2019. The move was possibly made to increase the subscription video on demand (SVOD) subscribers through their DTH platform. And this signifies that collaborative efforts in the DTH market might create a plethora of opportunities if OTT companies are seen as support or partners for the broadcasting business.

New Technologies and Partnerships will Fuel the New Market Demands

For years, space technology was considered one of the most expensive technologies, but now the scenario is changing the satellite market is adapting to the multidisciplinary technological ecosystem. This comes in the form of small satellites, VHTS, a drop in the satellite launch cost as well as capacity leasing, etc. Considering the high demand for bandwidth in the current market, Viasat and Eutelsat are set to launch their respective VHTS; Eutelsat Konnect VHTS and ViaSat-3, both with a K-band payload offering a capacity of more than 500 Gbps. VHTS is the need of the hour as the satellite market is evolving with a high-end video distribution format such as 8K and 4K.

Japan’s national broadcaster, NHK, partnered with Eutelsat in December 2018 to deploy 8K satellite video services in Japan. The 8K live transmission via Eutelsat’s 12 West B satellites used NHK’s High-Efficiency Video Coding (HEVC), a video compression standard that allows the data compression without degrading the video quality. On the same lines, during SES Industry Days 2019, SES, Samsung, and Spin Digital carried out a test to broadcast 8K content via satellite in the European region. The outlook of the emerging technologies proves that partnerships for meeting the new market demands are worth considering as some of the well-known satellite operators have started tapping the unexplored markets via partnerships.

Conclusion

Satellite broadcasting is the gold mine of opportunities if the satellite market is adapting to certain changes and meeting the demands of the rapidly evolving consumers. Hybrid solutions and OTT via satellite services will be gaining a lot of traction as the broadband infrastructure improvises in the different parts of the world. But DTH remains the current core commercial engine of the satellite broadcasting market. Asia, Middle East, Europe and Africa are the regions highly populated with the audience inclined towards traditional video consumption mode. Therefore, even though handheld devices are becoming more popular, satellite TV remains a competition for other platforms in these regions.